The Basic Principles Of Pacific Prime

This drop of almost 2 million in the variety of individuals 'without insurance (a decrease of around 4 percent) is certainly a favorable modification. With a softer economic situation in 2000 the most up to date reported gains in insurance coverage may not continue (Fronstin, 2001) (expat insurance). The decrease in the number of without insurance will not continue if the economic situation continues to be sluggish and health treatment costs continue to outpace rising cost of living

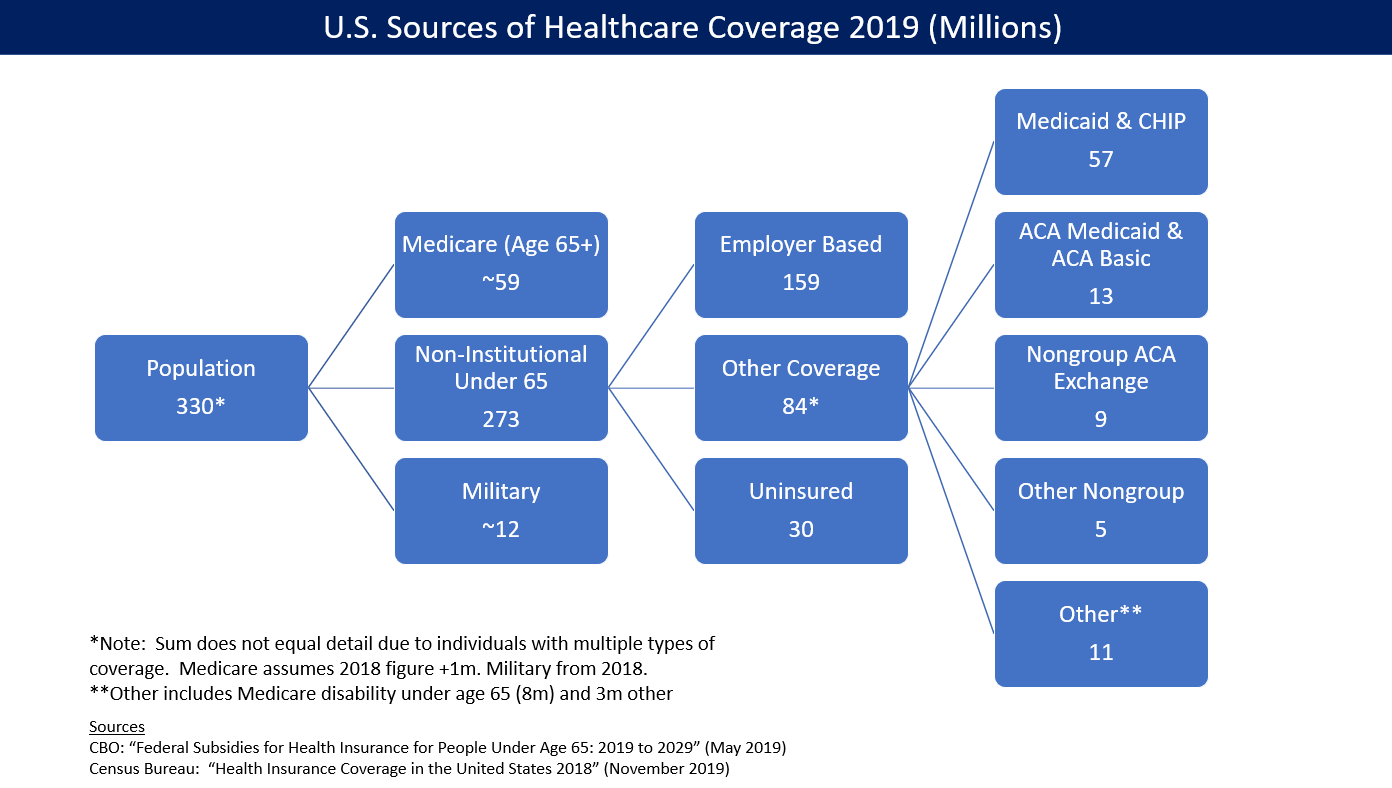

This is due to the fact that the information were accumulated for a duration of strong economic performance. Of the estimated 42 million individuals that were uninsured, just about regarding 420,000 (regarding 1 percent) were under 65 years of age, the age at which most Americans become qualified for Medicare; 32 million were adults in between ages 18 and 65, around 19 percent of all grownups in this age team; and 10 million were children under 18 years of age, regarding 13.9 percent of all children (Mills, 2000).

These quotes of the number of individuals without insurance are created from the yearly March Supplement to the Current Populace Study (CPS), conducted by the Demographics Bureau. Unless or else noted, nationwide estimates of individuals without medical insurance and proportions of the population with various sort of insurance coverage are based upon the CPS, the most extensively utilized source of estimates of insurance policy protection and uninsurance prices.

Everything about Pacific Prime

Still, the CPS is specifically helpful since it creates yearly price quotes reasonably swiftly, reporting the previous year's insurance policy coverage estimates each September, and because it is the basis for a consistent set of quotes for greater than 20 years, enabling for evaluation of trends in coverage gradually. For these reasons, as well as the extensive use the CPS in other research studies of insurance coverage that are presented in this report, we rely upon CPS estimates, with limitations kept in mind.

The estimate of the number of uninsured people broadens when a population's insurance standing is tracked for a number of years. Over a three-year period beginning early in 1993, 72 million people, 29 percent of website here the united state population, were without protection for a minimum of one month. Within a single year (1994 ), 53 million people experienced a minimum of a month without protection (Bennefield, 1998a)

Six out of every ten uninsured grownups are themselves employed. Although functioning does boost the possibility that and one's household participants will certainly have insurance coverage, it is not a guarantee. Also members of households with two permanent wage income earners have almost a one-in-ten opportunity of being without insurance (9.1 percent without insurance rate) (Hoffman and Pohl, 2000).

Examine This Report about Pacific Prime

New immigrants represent a substantial proportion of individuals without medical insurance. One evaluation has connected a substantial part of the current development in the size of the united state without insurance population to immigrants who showed up in the country between 1994 and 1998 (Camarota and Edwards, 2000). Current immigrants (those that involved the USA within the past 4 years) do have a high price of being uninsured (46 percent), however they and their children account for simply 6 percent of those without insurance across the country (Holahan et al., 2001).

The relationship between health and wellness insurance coverage and accessibility to care is well established, as documented later in this chapter. Although the partnership in between health and wellness insurance and health results is neither direct neither simple, a substantial scientific and wellness solutions research literature links health and wellness insurance coverage to improved access to care, better top quality, and enhanced individual and populace health and wellness condition.

Degrees of analysis for examining the impacts of uninsurance. It focuses specifically on those without any type of wellness insurance policy for any kind of size of time.

How Pacific Prime can Save You Time, Stress, and Money.

The troubles faced by the underinsured are in some aspects similar to those encountered by the without insurance, although they are normally less serious. Wellness insurance, however, is neither necessary nor adequate to obtain access to medical solutions. The independent and straight effect of wellness insurance coverage on accessibility to wellness solutions is well established.

Others will certainly acquire the healthcare they require even without wellness insurance coverage, by spending for it expense or seeking it from companies who use treatment free or at highly subsidized prices. For still others, wellness insurance policy alone does not make sure invoice of care as a result of various other nonfinancial obstacles, such as an absence of health and wellness care service providers in their community, limited access to transport, illiteracy, or linguistic and social distinctions.

Top Guidelines Of Pacific Prime

Formal research study regarding uninsured populations in the United States dates to the late 1920s and early 1930s when the Board on the Expense of Healthcare produced a collection of reports about funding medical professional workplace sees and hospitalizations. This concern ended up being prominent as the numbers of clinically indigent climbed up during the Great Anxiety.